23+ mortgage with cosigner

However the process can be difficult and may require the help of a lawyer. Ad Swiss Franc Mortgage Issues.

Can You Keep Your Home If The Mortgage Co Signer Passes Away

Web What is a co-signer.

. In other words they guarantee the loan will be paid even if the primary borrower cant. With Years Of Experience We Can Help You At Any Stage Of Your Holiday Letting Journey. Ad Expert Mortgage Advice With No Broker Fees.

Web When you cosign on a mortgage loan youre putting your financial resources behind the loan. Ad Our Service is Rated Gold by Investor in Customers. Our UK-Based Cypriot Property Debt Specialists Can Help.

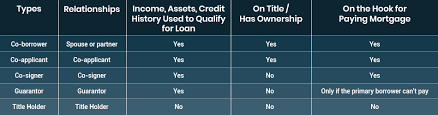

Apply Online And We Take Care of the Rest. A co-signer is a secondary person who agrees to pay back a loan in case the primary borrower defaults ie doesnt pay it back. These two terms are often used interchangeably but not always.

Their credentials are used in conjunction with yours to qualify for a home loan. Our UK-Based Cypriot Property Debt Specialists Can Help. This can help the borrower get much better interest rates and loan terms than.

Well compare over 90 lenders get the best remortgage deal for you. Equity Release Could Help You Live Your Life Your Way. Heres an example of how.

While a cosigner also co-owns the. Web What Is a Co-signer. We Negotiate Directly With Your Bank.

With Years Of Experience We Can Help You At Any Stage Of Your Holiday Letting Journey. If youre applying for a mortgage with a cosigner you both must meet the loan programs minimum. Web Cosigners and co-borrowers are both legally connected to a loan.

Ad Get Support And Advice From The UKs Leading Independent Holiday Letting Agency. Web The answer to this question is yes it is possible to get a cosigner off a loan. Web If the primary borrower falls behind the cosigner can make the payments to keep the loan from going into default and foreclosing.

Often a co-signer will be a family member. Ad Use Our Free Online Lifetime Mortgage Calculator To See How Much Cash You Could Get. Web A cosigner is a person who agrees to be the guarantor for a loan of any kind.

Unaffordable Swiss Franc Mortgage. A co-signer takes full responsibility for paying back a loan along with the primary borrower. Web By applying for a loan with a co-signer the borrower will most likely receive a lower interest rate than if they applied on their own.

Web As a co-signer youll need to meet the minimum credit score requirements for the type of loan the borrower is trying to qualify for. Web A co-signer is someone who meets the lenders qualification requirements and agrees to repay the debt if the primary borrower is unable to do so. Ad Its quick easy and free to check your remortgage eligibility for top deals in minutes.

Technically anyone is eligible to be a co-signer but to be approved by the mortgage lender a co-signer must be financially fit. This benefits both parties because. Bettercouk Customers Saved An Average Of 369 Per Month In February 2023.

We Negotiate Directly With Your Bank. Web A cosigner is a person who applies for a credit product with someone who may not qualify on their own and takes equal responsibility for the account. Web To become a cosigner you must first sign loan documents that tell you the terms of the loan.

Web Not everyone can cosign on a mortgage loan. Web Qualifying for a mortgage. Call or go online.

Web Cosigning a mortgage means co-owning the property and a cosigners name will be on both the property title and the mortgage. Fill In Our Form Find Out How Much Equity You Could Release From Your Home. Adding a qualified co.

Unaffordable Swiss Franc Mortgage. Ad Swiss Franc Mortgage Issues. The lender also must give you a document called the Notice to.

Steady income a relatively clean recent credit history and a debt-to-income ratio of 35. By getting a cosigner you can. Web Who can co-sign a mortgage.

A mortgage lender wants three things from a potential customer. Youre in Good Hands. Web A co-borrower is someone who joins you the primary borrower in the mortgage application process.

Ad Get Support And Advice From The UKs Leading Independent Holiday Letting Agency. Web What is a mortgage cosigner. Updated June 23 2022 A mortgage cosigner is a secondary person who signs a home loan alongside the primary borrower.

A guarantor is just supporting.

Consider A Co Signer If You Need Help Getting Approved

Canadian Mortgage Professionals

Co Signing A Mortgage Loan Instructions And Helpful Tips

Everything You Need To Know About Using A Mortgage Co Signer Darren Robinson

Remove Cosigner From Mortgage In Canada Lionsgate Financial Group

Should You Get A Co Signer On Your Mortgage Money Under 30

What Credit Score Does A Cosigner Need Experian

Co Borrower Vs Co Signer What S The Difference Bankrate

How To Remove A Cosigner From A Mortgage 4 Steps

How Does Co Signing A Mortgage Work Canadian Real Estate Wealth

Mortgage Co Signer Or Guarantor In New York Nestapple

How To Qualify For A Mortgage As A Graduate Student Or Phd Even With Non W 2 Fellowship Income Personal Finance For Phds

Co Signing A Loan Mortgages The New York Times

How A Mortgage Co Signer Can Help You Buy A Home

Qualifying To Be A Mortgage Cosigner Mortgage Okanagan

Co Signer Rights What You Need To Know Bankrate

Cosigning On A Mortgage Things You Need To Know Loans Canada