24+ taxes mortgage interest

Web So lets say that you paid 10000 in mortgage interest. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025.

:max_bytes(150000):strip_icc()/MostOverlookedTaxDeductions-29f2eea9bc044c90b9f5593fb267005a.jpg)

Mortgage Interest Deduction

Web Most homeowners can deduct all of their mortgage interest.

. Apply Get Pre-Approved Today. Web There are 3 common strategies for paying off your mortgage early heres how to decide which is best for you. How much mortgage interest is tax deductible in.

Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. Lock Your Rate Today. Web The Tax Cuts and Jobs Act TCJA of 2017 reduced the maximum mortgage principal eligible for the interest deduction to 750000 from 1 million.

Web Mortgages that existed as of December 15 2017 will continue to receive the same tax treatment as under the old rules. 2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply. Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is.

For example Lenas first-year interest expense totals 14857. At a personal tax rate of 24 this implies tax savings of 3566. 15 2017 can deduct interest on loans up to 1 million.

Web Mortgage interest is tax deductible. For tax years before 2018 you can also. Todays Mortgage Rates Today the average APR for the.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web Information about Form 1098 Mortgage Interest Statement including recent updates related forms and instructions on how to file. Ad Out-Earn Brick-And-Mortar Banks With Online Savings Accounts Without Visiting A Branch.

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Get Instantly Matched With Your Ideal Mortgage Lender.

Web Mortgage interest. 693751 or more. However higher limitations 1 million 500000 if married.

16 2017 then its tax-deductible on. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec. Web How to claim the mortgage interest deduction.

The amount you can deduct is limited but it can be a. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. 190751 364200.

In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly. Web 13 hours agoThe average daily rate for 30-year fixed-rate mortgages was 714 up 1 basis point from 713 the previous day and up 7 basis points from a week ago. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Ad Compare the Best Home Loans for March 2023. Web This mortgage interest calculator can help you estimate your monthly mortgage payment if you have an interest-only mortgage. FDIC Insured Online Banks Are A Great Place To Save And Offer Convenient Features.

Web Tax break 1. Homeowners with a mortgage that went into effect before Dec. 13 1987 your mortgage interest is fully tax deductible without limits.

364201 462500. Web The mortgage interest tax deduction allows you to deduct the interest you pay on your mortgage from your income taxes. 462501 693750.

Answer Simple Questions About Your Life And We Do The Rest. Web March 4 2022 439 pm ET. Web Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages.

Your mortgage lender sends you a Form 1098 in January or early February. Also if your mortgage balance is 750000. Look in your mailbox for Form 1098.

Web Aarons interest payments are greater than the standard deduction of 12950 so he chooses to itemize and claim the mortgage interest deduction on his tax return. To get an estimate and breakdown of your interest. And lets say you also paid 2000 in mortgage insurance premiums.

Use Form 1098 to report mortgage. So your total deductible mortgage. Web If you took out your mortgage on or before Oct.

But for loans taken out from.

Mortgage Interest Deduction How It Works In 2022 Wsj

Major Forex Pairs Definition Financial Dictionary Fxmag Com

Coming Home To Tax Benefits Windermere Real Estate

Majority Of Homeowners And Renters Benefiting From The Tax Cuts And Jobs Act John Burns Real Estate Consulting

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

Trading De Credito Bonds Exercicio Previo Pdf Pdf Standard Poor S Earnings Before Interest

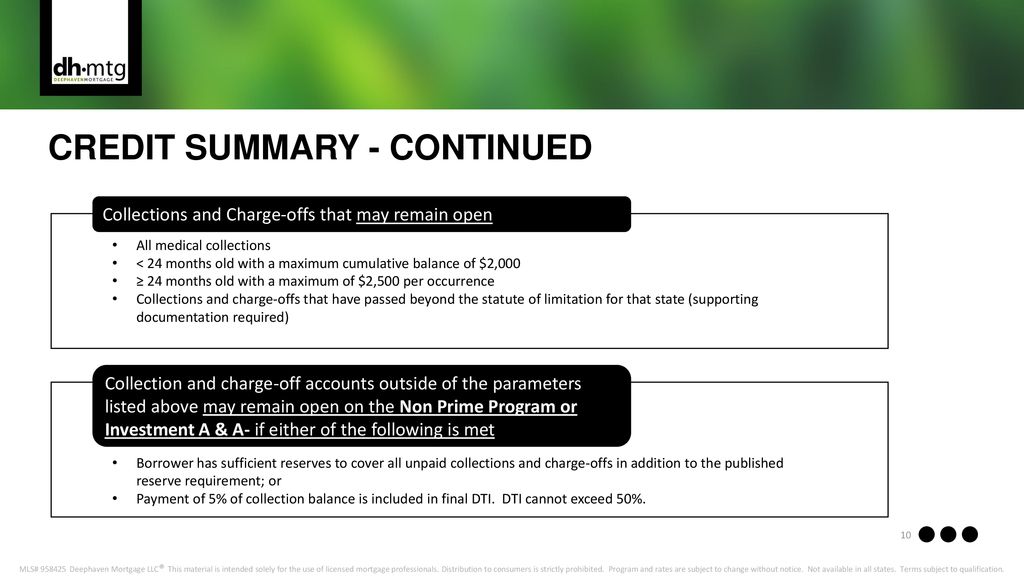

Delegated Underwriting Training Ppt Download

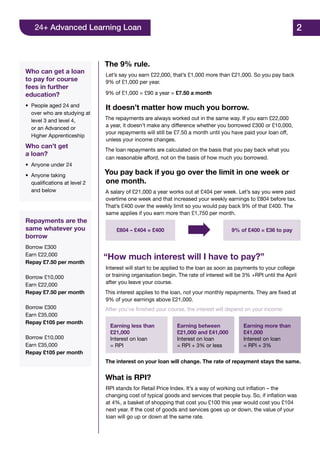

Faqs For Advanced Learning Loans Fe Loans

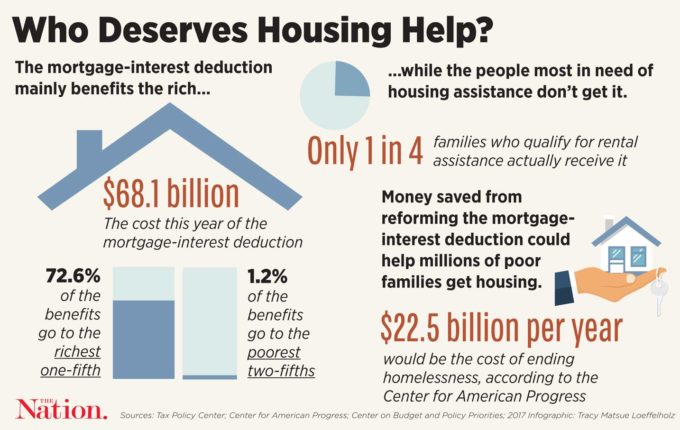

Long Sacrosanct The Mortgage Interest Deduction Comes Under Scrutiny The Nation

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

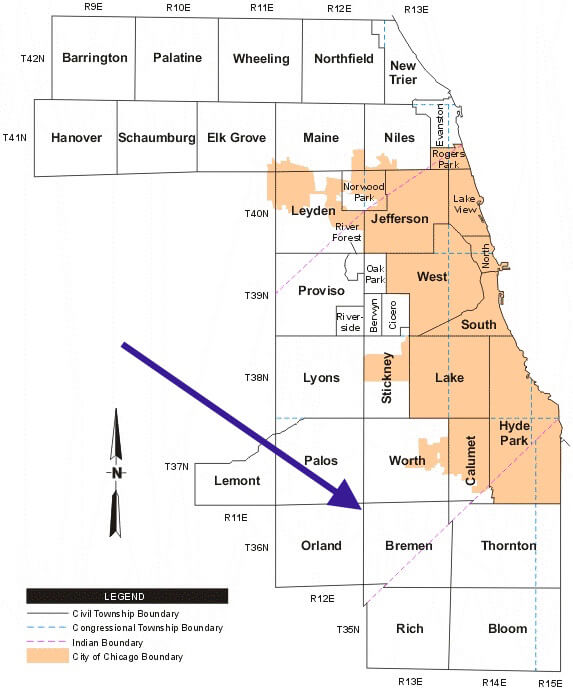

Suicidal Property Tax Rates And The Collapse Of Chicago S South Suburbs Wp Original Wirepoints

Faqs For Advanced Learning Loans Fe Loans

Maximum Mortgage Tax Deduction Benefit Depends On Income

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Document